I-20/DS-2019 Funding

United States (U.S.) universities are required by law to verify that students entering the U.S. with student visas have adequate financial resources to meet the expenses of their program of study. This will also be verified by the U.S. Department of State Consular Official during the student visa application.

In order to complete your Georgia Tech (GT) I-20/DS-2019 form request in iStart, you will need to show proof of funding for your program’s estimated costs of attendance. Estimates include the student's financial responsibility for tuition, fees, health insurance, books, and living expenses. Additional expenses such as dependent funding may also be required. For more details on OIE's estimates, see the FAQ at the bottom of this page. The estimated expenses listed on an I-20/DS-2019 form are for I-20/DS-2019 form issuance purposes only and they do not represent the actual charges to the student's account. Students are encouraged to review their bills and the websites referenced on this page for the actual cost of attendance.

Using the 4 Steps to Find Your Estimated Cost of Attendance, identify your estimated cost of attendance in the tables shown below. This is the amount of funding you must show to obtain an I-20 or DS-2019.

Refer to the Calculating Georgia Tech Funding section of this page to determine the estimated value of your GT funding as well as how much additional funding from another source may be required to obtain an I-20/DS-2019.

4 Steps to Find Your Estimated Cost of Attendance

Have you been awarded a Graduate Assistantship?

Using this guidance, determine which of two tables below you should refer to.

- Graduate Assistants:

- If you were awarded a Graduate Assistantship that includes a full tuition waiver, refer to the table below titled “Graduate Assistants,” which reflects your reduced tuition expenses after receipt of a tuition waiver.

- Full tuition waivers only waive the base rate portion of tuition, not the additional tuition expenses charged by Professional Programs, which can be identified on the tuition and fee tables linked at this page of the Bursar’s website. If you have additional questions about your tuition waiver, please contact the awarding department.

- If you were awarded a Graduate Assistantship that includes a partial tuition waiver, contact OIE at gradi20@oie.gatech.edu with subject line "Partial Tuition Waiver Support" for assistance determining your estimated costs and GT funding value.

- Partial tuition waivers are those that waive less than 100% of the base rate tuition.

- If you were awarded a Graduate Assistantship that includes a full tuition waiver, refer to the table below titled “Graduate Assistants,” which reflects your reduced tuition expenses after receipt of a tuition waiver.

- Graduate Students:

- If you are not receiving funding from Georgia Tech, refer to the table below titled “Graduate Students.”

- If you are receiving funding from Georgia Tech that does not include a full tuition waiver, refer to the table below titled “Graduate Students.”

- Graduate Assistants:

What is your program of study?

In the table you determined in Step 1, locate your program’s name to determine your tuition cost tier: Tier 1 (the base rate), Tier 2, Tier 3, or Tier 4

- OIE has grouped the Professional Graduate Programs as shown in the Bursar’s Tuition and Fees Rates chart into either Tier 2, 3, or 4 in order to estimate the tuition expenses you must show.

- For questions about OIE's estimated tuition expenses, see the FAQ below. For questions regarding professional programs or actual tuition expenses, contact the Bursar's office.

How many semesters of funding do you need to show?

In the table and tier you determined in Steps 1 and 2, determine the duration of funding required: either 1 Academic Year or 1 Semester for those seeking F-1 status. For those seeking J-1 status, the duration of funding required is for your entire program length.

- 1 Semester (4 months)

- If you have 12 or fewer required credits remaining to complete your degree program

- If you are transferring to the GT Atlanta Campus from another GT program for 1 semester

- 1 Academic Year (9 months)

- If you have more than 12 required credits remaining to complete your degree program

- If you are transferring to the GT Atlanta Campus from another GT program for more than 1 semester

- This applies to most degree-seeking F-1/J-1 students requesting a new I-20/DS-2019

- For confirmation of your remaining degree required credits, contact your academic department.

- 1 Semester (4 months)

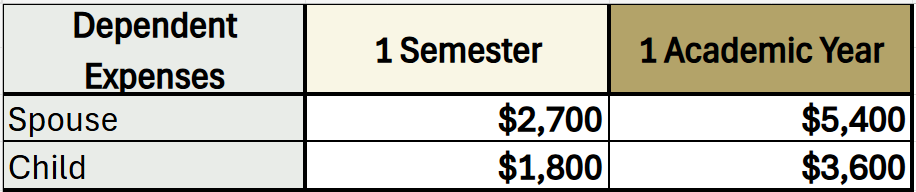

Do you have dependents?

If you will be joined by dependents in F-2/J-2 status, you will need to show additional funding as outlined here for each dependent.

- The dependent funding duration should match your funding duration, 1 semester or 1 academic year

- Add your dependents’ expenses to your Estimated Cost of Attendance

Find Your Estimated Cost of Attendance

- Refer to the “Total Required” row of the table, tier, and duration you determined in steps 1 through 3.

- Add your dependents' expenses to your Total Required if applicable.

- Students seeking J-1 status for more than 1 year should multiply the 1 semester / 1 academic year costs as needed to cover their entire program duration.

- This is the amount of funding you must show to obtain an I-20/DS-2019.

- For instructions on calculating the value of your funding from Georgia Tech and to determine if additional funding from another source is required, see the section of this page below titled Calculating Georgia Tech Funding.

Graduate Estimated Cost of Attendance Tables

Using the 4 Steps to Find Your Estimated Cost of Attendance above, refer to the appropriate table below.

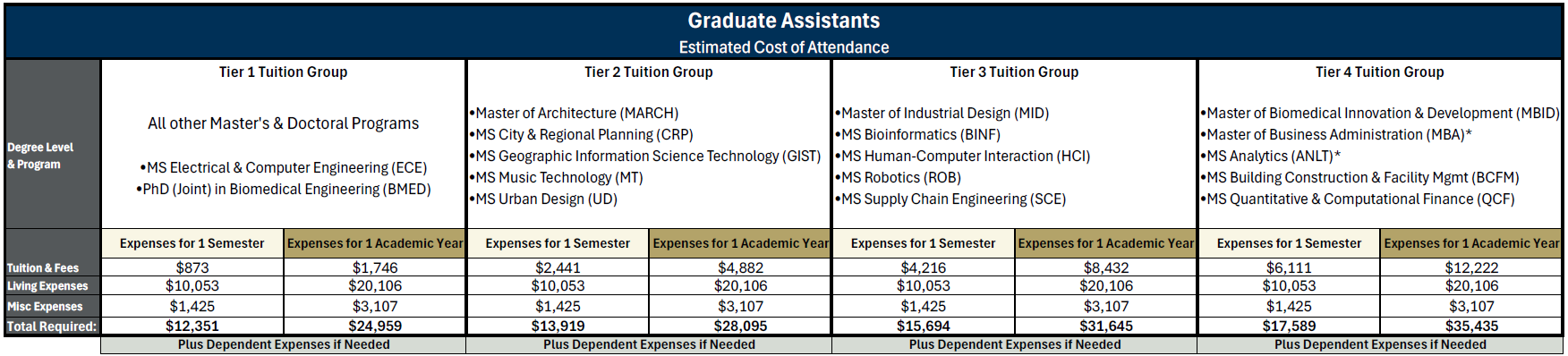

Refer to the table below if you have been awarded a full tuition waiver.

*MBA and MS Analytics students with partial tuition waivers should contact gradi20@oie.gatech.edu with subject line "Partial Tuition Waiver Support" for assistance determining your Tuition & Fees cost. Partial tuition waivers are those that waive less than 100% of the base rate tuition. Please attach a copy of the GT funding letter.

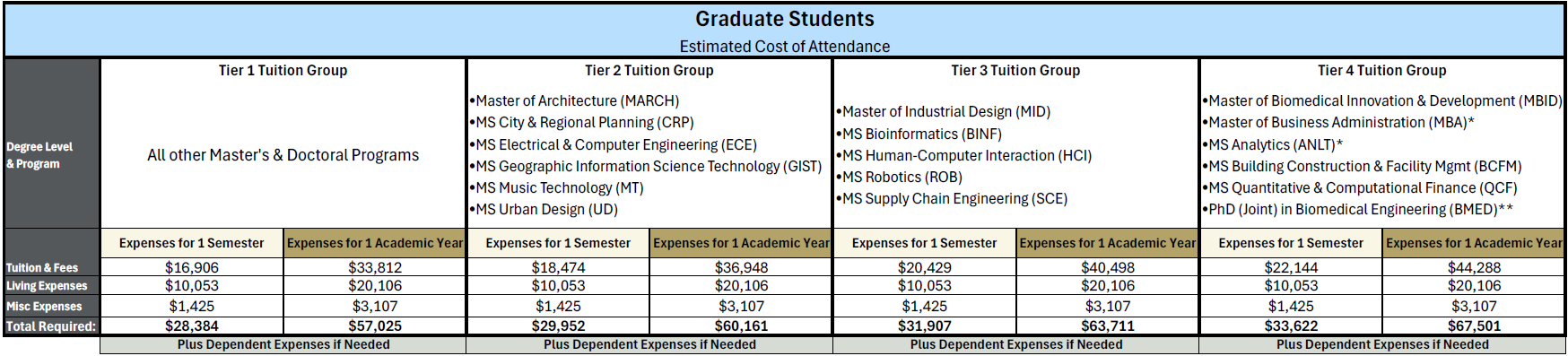

Refer to the table below if you have not been awarded a full tuition waiver.

*MBA and MS Analytics students with partial tuition waivers should contact gradi20@oie.gatech.edu with subject line "Partial Tuition Waiver Support" for assistance determining your Tuition & Fees cost. Partial tuition waivers are those that waive less than 100% of the base rate tuition. Please attach a copy of the GT funding letter.

**Joint PhD Biomedical Engineering Tuition & Fees cost with no tuition waiver is $24,422 for 1 semester and $48,844 for 1 academic year.

Financial Documentation Requirements

Proof of funding to cover your estimated cost of attendance must be uploaded to your I-20/DS-2019 Request in iStart.

For acceptable documentation types and requirements, including for financial award letters from Georgia Tech, review the guidance on the OIE Financial Document Requirements page.

Calculating Georgia Tech Funding

If you have been awarded a stipend, fellowship, or scholarship from Georgia Tech, you may upload documentation of your award to iStart to count toward your estimated cost of attendance funding. Follow the three steps below to calculate the estimated value of your GT funding as well as how much additional funding from another source may be required to obtain an I-20/DS-2019.

Reminders:

- Tuition waivers are not an acceptable form of funding to count toward your Estimated Cost of Attendance. The tuition and fee expenses shown in the Graduate Assistants Estimated Cost table have already been reduced to show your estimated financial responsibility after receipt of a full tuition waiver.

- If your award letter states the funding value in terms of a 12 month year (fall, spring, and summer), you will need to divide it by 12 to calculate its monthly value for I-20/DS-2019 purposes.

- 1 semester = 4 months and 1 academic year = 9 months in OIE's cost and funding estimates.

Identify Your Estimated Cost of Attendance

- Refer to the 4 Steps to Find your Estimated Cost of Attendance section of this page above for instructions.

Total Your GT Funding

Stipends

- Multiply your GT monthly stipend value x 4 if you will receive a stipend for just 1 semester or if you only need to show funding for 1 semester.

- Multiply your GT monthly stipend x 9 if you will receive a stipend for at least 1 academic year and you need to show funding for 1 academic year.

- If you are unsure of the duration of funding you need to show, return to Step 3 in the 4 Steps to Find Your Estimated Cost of Attendance above.

Fellowships and Scholarships

- Referring to your award letter, determine the dollar value of any fellowships and scholarships for the duration of funding required. Do not include the value of any tuition waivers.

- If you are unsure of the duration of funding you need to show, return to Step 3 in the 4 Steps to Find Your Estimated Cost of Attendance above.

- Referring to your award letter, determine the dollar value of any fellowships and scholarships for the duration of funding required. Do not include the value of any tuition waivers.

Compare Your Estimated Cost of Attendance to Your GT Funding

- If your Estimated Cost of Attendance is greater than your GT Funding, you need to show proof of additional funding through other sources such as personal funds, sponsor funds, or other acceptable liquid funds as outlined on the OIE Financial Document Requirements page.

- If your GT Funding (stipends, scholarships, and fellowships) is greater than your Estimated Cost of Attendance, you only need to provide documentation of your GT funding in your I-20/DS-2019 request in iStart. Review the OIE Financial Document Requirements page to ensure your GT award letter will meet OIE's requirements.

FAQs

- Why does my full/100% tuition waiver not cover my entire cost of attendance for immigration purposes?

- The estimated cost of attendance includes tuition as well as fees, living expenses, and miscellaneous expenses such as health insurance. Even if your tuition has been waived, you must show proof of funding for the non-tuition expenses such as housing. In some cases, an assistantship stipend is sufficient to cover all of OIE’s estimated cost of attendance. If the stipend is not sufficient, you will need to provide proof of additional funds from another source.

- Some degree programs charge tuition at the base rate (shown in Tier 1 above), while others called “professional programs” charge tuition at differential rates, meaning the base rate plus additional fees (shown in Tiers 2, 3, and 4 above). In most cases, full/100% tuition waivers only cover the base rate portion of the tuition expenses. Therefore, students in professional programs often need to show proof of additional tuition funding through stipends or personal/sponsor funds. Professional programs can be identified on the tuition and fee tables linked at this page of the Bursar’s website. If you have additional questions about your tuition waiver, please contact the awarding department.

- I will receive a stipend for 12 months in a year. Why will OIE only count 9 months towards my funding?

- OIE’s estimated costs are based on 1 semester (4 months) or 1 academic year (9 months), so the maximum stipend duration that is counted is equal to 4 or 9 months. To determine your duration of funding, refer to Step 3 in the 5 Steps to Find your Estimated Cost of Attendance above. If you find that your stipend is not sufficient to cover your estimated cost of attendance, you will need to show proof of additional funds from another source.

- Why is all of my funding not listed on my I-20/DS-2019 form?

- OIE will not list the total amount of funding that a student has available and will instead only list the funding that is needed to meet the estimated expenses. Therefore, if your funding exceeds your estimated expenses, you will find that not all of your funding is listed on the I-20/DS-2019.

- I’m an incoming F-1 student transferring from an online GT program or from GT Europe with less than 12 credits required to graduate, so I only have 1 semester of school left. Do I still have to show 1 full academic year of funding?

- No, you may show just 1 semester (4 months) of funding, and your I-20 program dates will be just 1 semester in length.

- I will be living with a friend/relative who will not charge me for rent. Can the amount of living expenses I need to show be decreased?

- All F-1 and J-1 students must provide proof of funding for living expenses and other costs such as health insurance. OIE's living expense funding requirements are standardized and cannot be decreased based on a student’s particular circumstances.

- I will not be using Georgia Tech’s student health insurance plan because I already have health insurance that meets the waiver requirements. Can the amount of miscellaneous expense funding I need to show be decreased?

- All F-1 and J-1 students must provide proof of funding for living expenses and other costs such as health insurance. OIE's miscellaneous expense funding requirement, which includes health insurance, is standardized and cannot be decreased based on a student’s particular circumstances.

- How does OIE determine the expense estimates?

- Tuition: Graduate tuition estimates are based on actual rates for 12 credit hours of enrollment at the out-of-country tuition rate. Graduate Student tuition rates for each term can be found in the .pdfs linked at this page of the Bursar’s website. Graduate Assistant tuition rates for each term can be found by clicking the “GRADUATE ASSISTANT RATES” link inside the Bursar chart for a particular term.

- Some programs charge tuition at the base rate, whereas professional programs charge differential tuition, meaning the base rate plus additional fees. Professional programs can be identified on the tuition and fee charts linked at this page of the Bursar’s website. OIE has grouped the Graduate Professional Programs into either Tier 2, 3, or 4 in order to estimate the tuition expenses you must show.

- Fees: Fee estimates are based on actual rates for 12 credit hours of enrollment each term and include the Mandatory Student Fees and International Student Fee, which can be found on the charts linked in this page of the Bursar’s website. They are the same for Graduate Students and Graduate Assistants.

- Living Expenses: Estimates for living expenses are based on the Out of Country, Off Campus Housing Allowance and Food Service Plan per the Financial Aid Office. They are the same for Graduate Students and Graduate Assistants.

- Miscellaneous Expenses: Estimates are based on Mandatory Health Insurance costs per Stamps Health Services and on the Out of Country, Off Campus Books, Course Materials, Supplies, and Equipment costs per the Financial Aid office. They have been adjusted to reflect expenses for either 4 or 9 months. They are the same for Graduate Students and Graduate Assistants.

- Tuition: Graduate tuition estimates are based on actual rates for 12 credit hours of enrollment at the out-of-country tuition rate. Graduate Student tuition rates for each term can be found in the .pdfs linked at this page of the Bursar’s website. Graduate Assistant tuition rates for each term can be found by clicking the “GRADUATE ASSISTANT RATES” link inside the Bursar chart for a particular term.